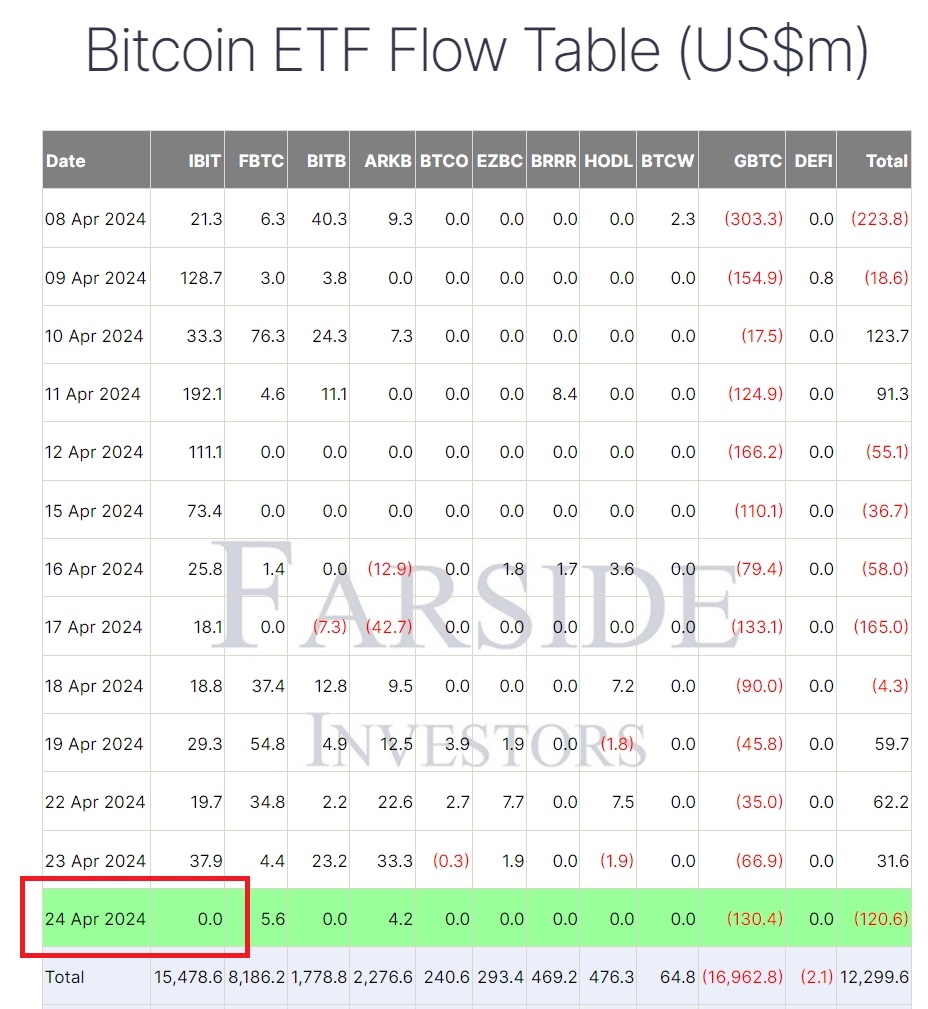

BlackRock iShares Bitcoin Trust (IBIT) has experienced its first day of zero inflows since the US introduced Bitcoin exchange-traded funds (ETFs) in January. Since its start on January 11th, IBIT has steadily drawn investments totaling millions of dollars every single day, amassing approximately $15.5 billion in just seventy-one days. On April 24, BlackRock’s inflow streak came to an end when it registered zero dollars in inflows.

There was a dry stretch for the majority of the other Bitcoin ETF participants as well. Out of the eleven Bitcoin exchange-traded funds (ETFs) established in the US, just two—ARK 21Shares Bitcoin ETF (ARKB) and Fidelity Wise Origin Bitcoin Fund (FBTC)—received inflows of over $5 million and $4.2 million, respectively.

Grayscale Bitcoin Trust ETF (GBTC) was also bleeding money. On April 24, GBTC detected outflows of $130.4 million. Consequently, GBTC removed $120.6 million from the spot Bitcoin ETFs that day. While this is an unprecedented situation for IBIT, it is typical for other ETFs to experience similar challenges. For instance, in the past two weeks, Fidelity’s FBTC has had three days with zero inflows.

As of this writing, the U.S. Bitcoin ETF market holds a total value of $12.3 billion in Bitcoin. Nevertheless, the outflows from GBTC have somewhat cancelled out the inflows from the other nine Bitcoin ETFs. Withdrawals from GBTC have surpassed $17 billion as of January 11th. There are a number of players in the Bitcoin ETF market that are also attempting to get Ether ETFs into the US market. The SEC, however, has lately put off making decisions on whether or not to approve a number of them.

“The Commission believes it is necessary to establish a longer timeframe to decide whether to approve or reject the proposed rule change. This will allow it ample time to review the proposed rule change, as amended by Amendment No. 1,” the agency stated in its April 23 notice. A 60-day extension has been granted to June 23 for the SEC’s determination on Grayscale’s request to convert their ETH Trust to a spot ETH exchange-traded product on NYSE Arca.