Bitcoin Bull Analysis! One More Sign! Recent analyses clearly show the enthusiasm of long-term Bitcoin investors. Is their reluctance to sell stemming from an intentional accumulation strategy predicting future profits?

General Table

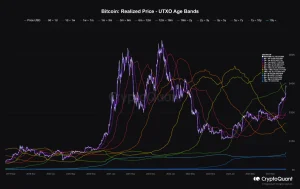

In general, 83.6% of Bitcoin investors are currently in profit. This is close to the levels seen when Bitcoin retraced from the all-time high (ATH) in November 2021. It indicates investors’ belief in the long-term value of Bitcoin.

Subgroups

However, when looking more closely at realized prices across groups, a nuanced picture emerges. Despite the overall bullish sentiment, a significant subgroup continues to remain underwater. For instance, the group that invested in BTC 2-3 years ago is still grappling with an average realized price of $45,000, contributing to the persistence of average losses.

It may attract your attention: Bitcoin Applications to the SEC are on the Record Number!

Conclusion

These results are intriguing. Some investors may choose to sell when their Bitcoin purchase prices approach breakeven, indicating a break-even point rather than a profitable exit. Bitcoin Bull Analysis

Possible Explanations

There are several possible explanations for why this subgroup is still underwater. First, these investors may have experienced significant losses before Bitcoin reached its all-time high (ATH). Second, they might anticipate Bitcoin’s price reaching a higher level. Third, these investors may believe in the long-term value of Bitcoin and expect to eventually turn a profit despite current losses.

Prospects for The Future

The behavior of this subgroup could influence the future of the Bitcoin market. If these investors choose to hold onto their assets, anticipating a higher Bitcoin price, this could provide additional support to the market. However, if these investors decide to sell their assets when they break even, it could create selling pressure in the market.

Conclusion

Bitcoin investors generally exhibit high enthusiasm; however, examining realized prices based on groups reveals that some investors are still underwater. The behavior of these investors could impact the future of the Bitcoin market.

You can present your own thoughts as comments about the topic. Moreover, you can follow us on Telegram, Twitter, and YouTube channels for the kind of news.