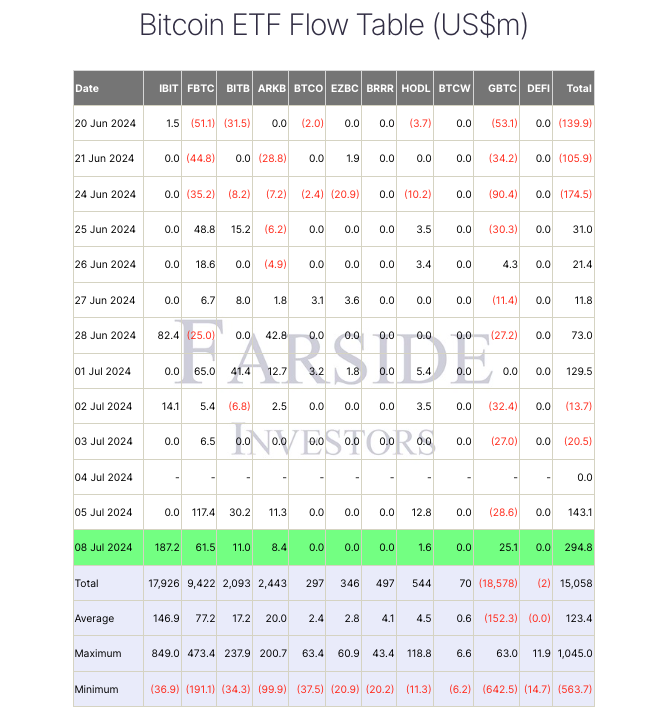

Amid a faltering crypto market, Bitcoin exchange-traded funds (ETFs) had their most notable daily net flow on July 8 more than a month ago. The eleven Bitcoin ETFs combined attracted $295 million, the first day of the past three trading weeks with positive net inflows across all funds.

BlackRock and Fidelity Lead Inflows

With a daily inflow of $187.2 million, BlackRock‘s Bitcoin ETF topped the race; followed by Fidelity, with gains of $61.5 million. Securing $25.1 million in inflows, the Grayscale Bitcoin Trust (GBTC) also saw a rare day of positive price activity.

Since June 5, when the ETFs drew almost $488 million in additional money, this is the most important day of inflows.

Market Concerns Over BTC Sales

The influx rise coincides with more general market worries concerning significant Bitcoin sales from the German government and anticipated Mt. Gox creditor defaults. The German government has so far sent approximately 26,200 BTC, worth at $1.5 billion at current rates, to market makers and exchanges. Based to statistics from Arkham Intelligence, it still has 27,460 BTC, valued around $1.57 billion.

Furthermore, there are worries that $8.5 billion in Bitcoin might flood the market in the next months as the failed Japanese cryptocurrency exchange Mt. Gox starts reimbursing creditors who lost their money to a hack in 2014. Still, some experts think worries over Mt. Gox Bitcoin sales could be overdone.

Over the last two trading weeks, the price of Bitcoin continuously dropped; on July 5, it dropped to $53,600, the first time the currency sold below $54,000 since February this year. The notable inflows into Bitcoin ETFs show institutional investors and large-scale purchasers’ ongoing confidence despite market volatility, suggesting that the present downturn might provide a purchasing opportunity.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.