Roger Ver, a well-known Bitcoin investor and Bitcoin Cash advocate, was detained in Spain last weekend after being accused by the US of mail fraud, tax evasion, and fraudulent tax returns. The US authorities will ask for his extradition.

The Justice Department revealed on Monday that Ver avoided at least $48 million in US taxes.

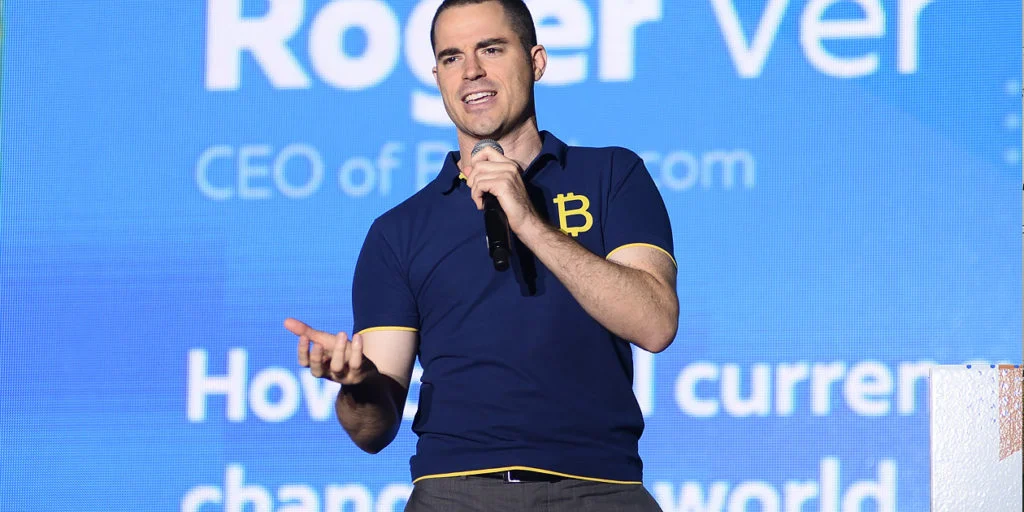

In the early days of cryptocurrencies, Ver was known as Bitcoin Jesus. He created Bitcoin Cash after he split with a number of Bitcoin miners who did not support the blockchain upgrades. Ver championed Bitcoin Cash.

As per the most recent declaration, in the beginning of 2014, Ver renounced his US citizenship and became a citizen of St. Kitts and Nevis. He still had holdings in MemoryDealers and Agilestar, US-incorporated computer and networking equipment companies.

The US government argues that Ver began purchasing Bitcoins for his own use and the use of his companies in 2011. He is alleged to have failed to pay an exit tax in the course of his expatriation. He is said to have also deceived a law firm, which he employed to fill out counterfeit tax forms.

Supposedly, Ver was demanded by US law to submit tax returns that showed gains from the constructive sale of his worldwide assets, which also included the Bitcoins, and the fair market value of his assets after expatriation. The Justice Department emphasized that he was supposedly forced to pay an “exit tax” on those capital gains.

US investigators reckon that Ver and his companies had 131,000 bitcoins at the time he became a citizen of St. Kitts and Nevis. The two companies possessed 73,000 bitcoins.

The Justice Department stated that Ver provided the law firm and appraiser with either wrong or incomplete information about how many bitcoins Ver and his companies held. The law firm supposedly came up with and submitted overvalued tax returns that undervalued the two companies and their 73,000 bitcoins and failed to show that Ver owned any bitcoins.

Additionally, Ver’s company also sold “tens of thousands” of bitcoins for $240 million in November 2017. The US authorities required him to file the profits with the IRS and pay tax on the dividends from the two US-incorporated companies.

The Justice Department stated that Ver’s 2017 personal tax return showed no profit or payment of tax on the Bitcoins of MemoryDealrs and Agilestar. Ver is said to have caused IRS losses of at least $48 million.