The China Securities Regulatory Commission (CSRC) has decided to limit short-selling activities as part of new measures to address recent stock market volatility. According to a notice posted on the CSRC’s WeChat account, the lending of restricted stocks will be suspended as of January 29.

You might like: Bitcoin and Cryptocurrencies: The Latest Status – January 29

Restricted stocks are typically shares that are subject to certain selling and transfer restrictions. These types of restrictions are often imposed as part of company management policies or employee compensation plans, and therefore limit the free sale of these shares. However, traders engaged in derivative contracts, particularly those looking to short sell, can borrow these shares.

According to the CSRC’s statement, the purpose of the new rules is to “highlight fairness and reasonableness, reduce the efficiency of the lending of securities, limit the advantages of institutions in the use of information and tools, allow all investors more time to digest market information, and create a fairer market order.”

The China Securities Regulatory Commission (CSRC)

China is continuing its efforts to control capital outflows. According to a report by Bloomberg, the country’s largest brokerage firm ended its practice of lending stocks to retail investors on January 22, at the direction of regulators, and raised margin requirements for institutional investors.

Other measures have been taken in October, such as the local regulatory body’s announcement of new rules for hedge funds, limiting the lending of stocks by strategic investors, and tightening oversight of arbitrage activities.

Short selling is a financial strategy in which an investor borrows shares and sells them on the market, expecting the share to lose value. This strategy is used by investors who believe that a stock is overvalued or is likely to lose value.

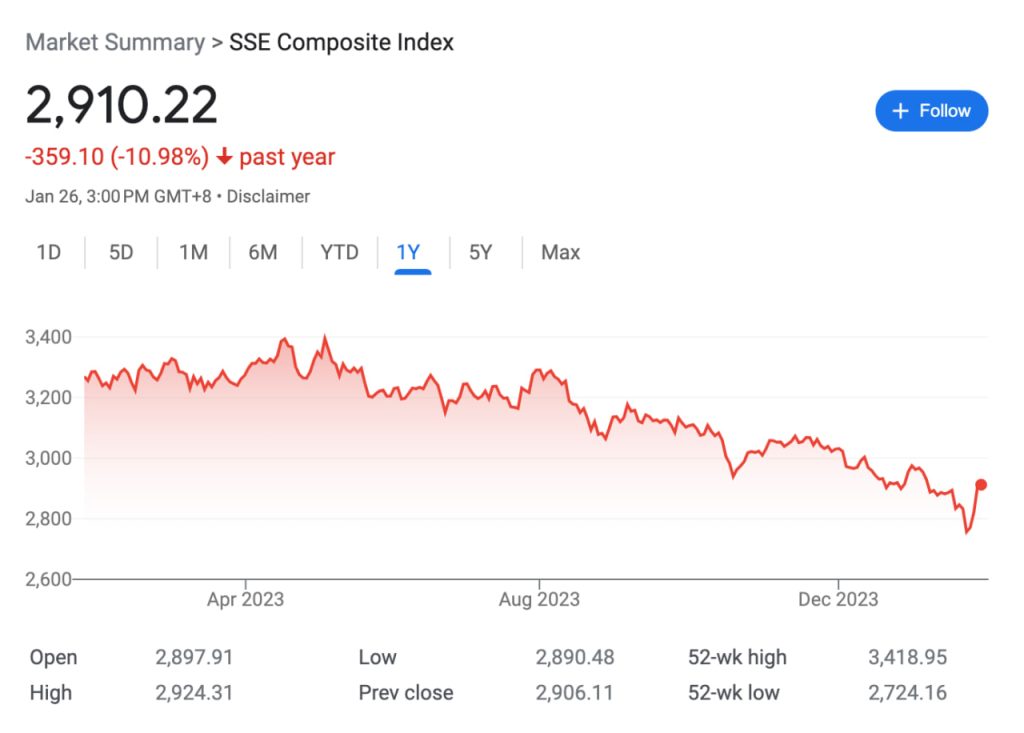

In the past year, China’s stock market has faced significant challenges. The CSI 300 Index fell 11% in 2023, while the MSCI China Index fell 10% this year and fell 23.6% in 2022 and 22.8% in 2021. In addition, according to the South China Morning Post, foreign investors sold 170 billion yuan (US$23.4 billion) worth of shares on the domestic market between July and November last year.

Despite market challenges, China continues to invest heavily in pilot projects for its central bank digital currency (CBDC) – the digital yuan. Among the emerging use cases for this technology are integrations with various foreign banks and using the digital yuan to settle commodity transactions on the Shanghai Stock Exchange.