Expectations that spot Ether exchange-traded funds (ETFs) might be authorized and introduced as early as the end of this week have sent Ether’s price upwards beyond $3,300. TradingView data shows that ether is trading at $3,331, a 16% rise from $2,909 in the last week.

Looking forward ETF approval

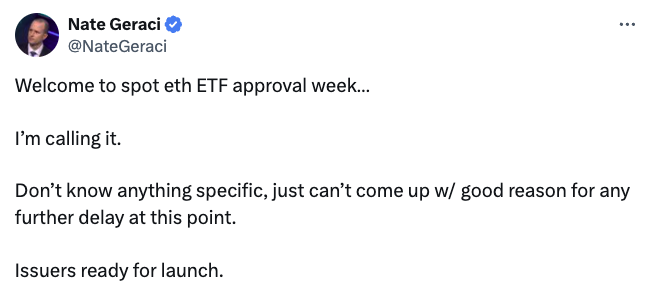

Nate Geraci, president of The ETF Store and ETF expert, visited X (previously Twitter) to foretell the eight spot ETH ETFs’ impending approval. Welcome to ETH ETF approval week. Not knowing anything particular, simply can’t come up [with] reasonable cause for any further delay at this moment, Geraci tweeted on July 14.

Hoping to get the SEC’s final clearance to start listing their spot Ether ETFs, many ETF issuers, including VanEck and 21Shares, have submitted revised registrations in recent weeks.

Possible Effects on Ether’s Value

Most analysts see the possible introduction of these ETFs as a major factor influencing Ether’s price in next months. Managing partner of MV Global, a cryptocurrency investment company, Tom Dunleavy anticipates the ETFs to draw in much to $10 billion in fresh inflows in the next months after their introduction. By the end of the year, he expects this flood of Ethers will push prices to fresh all-time highs.

Dunleavy also pointed out that Wall Street might find Ether ETFs more palable than Bitcoin ETFs. “This is a lot easier sell for financial advisers than ‘digital gold,’ he said.” Dunleavy thinks that once the money is released, Ether’s price—which has trailed behind Bitcoin for the last 18 months—will bounce quickly.

The expectation around the possible approval of spot Ether ETFs has caused the crypto community to be somewhat optimistic. Investors and analysts are eagerly watching the SEC’s next actions as the acceptance of these ETFs might establish a standard for next digital asset investments and perhaps result in more general acceptance.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.