Grayscale Removes MATIC, Adds AVAX and XRP in Fund Rebalance! Changing allocations affect Grayscale’s Digital Large Cap Fund, DeFi Fund and Smart Contract Platform Ex-Ethereum Fund funds.

You might like: As Bitcoin Rises, Crypto Sector Employment Falls

Asset manager Grayscale has rebalanced the weights of three of its crypto funds, removing tokens such as Polygon (MATIC).

According to an announcement on January 5, Grayscale’s Digital Large Cap Fund (GDLC), DeFi Fund (DEFG) and Smart Contract Platform Ex-Ethereum Fund (GSCPxE Fund) funds were affected.

According to the revised composition of the Digital Large Cap Fund, Bitcoin (BTC) holds 69.15%, Ether (ETH) is allocated 21.90%, Solana (SOL) 3.65%, XRP 2.54%, Cardano (ADA) 1.62% and AVAX makes up 1.14% of the fund. As a result of the rebalancing, MATIC was removed from GDLC.

What does Grayscale’s DeFi Fund include?

Changes in Grayscale’s DeFi Fund include the removal of Curve DAO (CRV) token from the portfolio. The new basket includes Uniswap (UNI) with a 41.11 allocation, Lido (LDO) with 23.90, MakerDAO (MKR) with 13.39, Aave (AAVE) with 12.63 and Synthetix (SNX) with 8.97.

Although it was removed from one of the portfolios, MATIC is still in the GSCPxE Fund and no tokens have been added or removed from this fund. The updated composition shows that SOL has a 44.54%, ADA 19.77%, AVAX 13.89%, Polkadot (DOT) 9.75%, MATIC 8.25% and Cosmos (ATOM) 3.80% share.

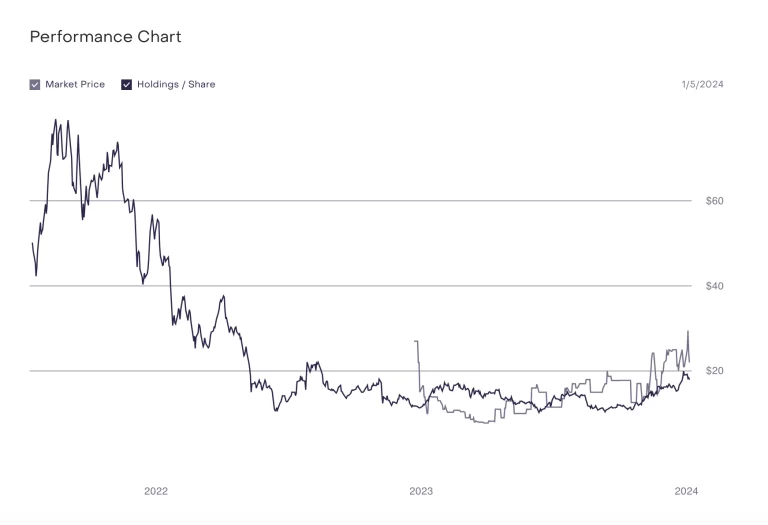

Fund managers typically perform this process on a quarterly basis to optimize the fund’s performance according to current market conditions, risk assessments and investment goals. Their funds that aim to provide exposure to decentralized financial markets, such as the DeFi Fund, have been negatively affected by the crypto winter. At the time of writing, their shares were trading at $22, down 9.28% in the past 24 hours.

The crypto asset manager is one of the companies seeking regulatory approval for a spot Bitcoin exchange-traded fund (ETF) in the United States. For this purpose, it is planned to convert the over-the-counter Grayscale Bitcoin Trust into a listed BTC ETF. A decision announcement from the U.S. Securities and Exchange Commission (SEC) is expected on January 10.