Binance leveraged transactions will be explained on this article. Also, we have prepared a guide on how to calculate profit and loss in Binance leveraged transactions. As it is known the world of cryptocurrency offers high return potential for investors through leveraged transactions. However, it also contains significant risks. Leading cryptocurrency exchanges like Binance offer greater opportunities for investors by providing a leveraged trading option. However, calculating profit and loss in leveraged transactions can be complex.

You might like: What are Binance Options? How to Use?

What is Leverage?

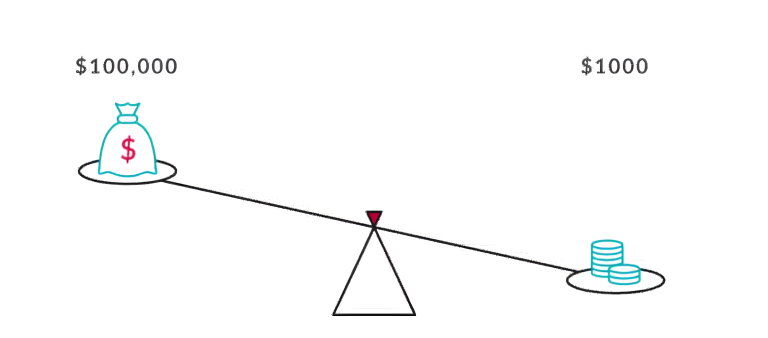

Leverage allows you to open larger positions with less capital. For example, if you are using 10x leverage, you can open a position worth $10,000 with a capital of $1,000. However, keep in mind that leverage also increases potential losses.

Calculating Profits and Losses in Binance Leveraged Transactions

Opening a Position: As the first step, you open a leveraged trading position on Binance. You use the leverage level you have set during this transaction. For example, if you are using 10x leverage, you can open a position worth $10,000 with a capital of $1,000.

Calculating Profits and Losses: At the end of the transaction, calculate the difference between the initial and final price of your position. If you opened a long position and the price has risen, your position is profitable. Conversely, if you opened a short position and the price has fallen, your position is profitable.

Leverage Effect: Leverage can amplify gains and losses. For example, if you are using 10x leverage, the profit or loss of your position will increase tenfold.

Financing Fees: You pay financing fees every day during leveraged transactions on Binance. These fees reflect the leveraged funding required to keep your position open.

Stop-loss and Take-profit Orders: You can use stop-loss and take-profit orders to better manage your profit and loss calculations. These orders automatically close your position and limit your profit or loss.

Conclusion: Net Profit or Loss: Calculate whether your position is profitable or unprofitable at the end of the transaction. This will help you determine how much of your initial capital you have gained or lost.

What to Do Before Starting Leveraged Transactions on Binance

Account Creation: First, you need to create a Binance account and complete the identity verification process. If you don’t have a Binance account, you can register with our 20% commission discount link.

Funding: You need to deposit cryptocurrency or fiat money into your account to invest.

Selecting Leverage Level: You need to decide which leverage level to use. Be careful when selecting the leverage level.

Trading Strategy: Set a trading strategy. Setting stop-loss and take-profit levels helps limit your risk.

Leveraged transactions offer high return potential for investors, but they also carry a high risk. Therefore, you should think carefully before starting leveraged transactions. A good risk management strategy and up-to-date market analysis are essential for a successful leveraged transaction. We hope this guide gives you a better understanding of how to calculate profit-loss in Binance leveraged transactions.

How to Open an Account on the Binance Exchange

To trade, you need to register at the Binance Exchange. After registering, you can use the leveraged transactions.

You can freely share your thoughts and comments about the topic in the comment section. Additionally, please don’t forget to follow us on our Telegram ,YouTube and Twitter channels for the latest news.