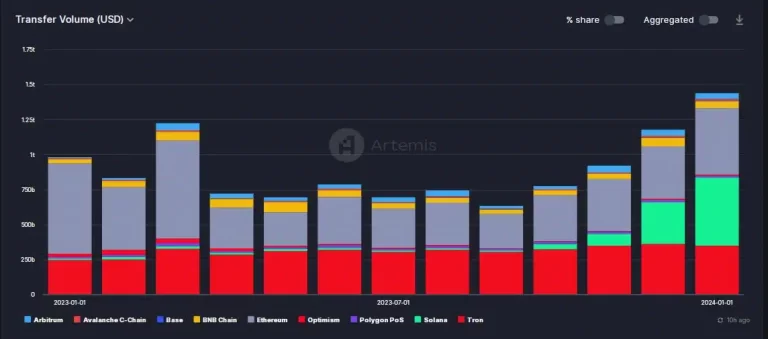

The volumes of stablecoins transferred over the Solana network have surpassed those of the much-preferred Ethereum network and Tron (TRX) network.

You might like: Binance ‘s New Delisting Decision

It is believed that Solana itself is leading the way in these transfers over the Solana network. Because Solana’s market share was only 1.17% a year ago, it has risen to 33.76%. SOL regained its upward momentum by rising above $100 for the first time in over two weeks.

The volume of stablecoins passing through the Solana network reached an all-time high in January, making it the largest blockchain. Solana, which surpassed the Ethereum and Tron (TRX) networks for the first time, also added value to the SOL coin.

According to data analysis by the AMBCrypto company, a record $497 billion worth of stablecoins were transferred to the Solana blockchain in January.

In addition, Solana’s market share has risen to 33.76%, up from 1.17% a year ago.

Solana Is Increasing Its Volume Every Day

The stablecoin transfers made over the SOL network are increasing exponentially every day. Demand for stablecoins has increased significantly in the last two months, especially due to the optimism associated with the approval of spot Bitcoin ETFs.

As the cryptocurrency market revives, people have begun to invest in their favorite projects using stablecoins. However, unlike the bear market, when Ethereum and Tron controlled more than 80% of the stablecoin volumes, this time the only reason for the rise was the Solana network.

When November and January are considered separately, the first striking data is that the monthly stablecoin volumes on Solana have increased fivefold. When we compare this data with Ethereum and Tron separately, Ethereum increased by 31%, while Tron remained almost the same.

Can We Attribute SOL Network’s Rise to USDC?

According to the DeFiLlama company, USD Coin (USDC), which has a significant share of 56% of the total supply on Solana, is a serious player. It is also interesting that USDC’s market capitalization on Solana increased by more than 14% last month, while most other stablecoins declined.

This strongly showed that the USDC volumes on SOL are the main factors driving the overall stablecoin transfer volumes.