MarginFi is a decentralized margin protocol that provides a margin trading and lending platform on the Solana network. Also, the protocol makes it easier for investors to access margin from a single place across the entire Solana ecosystem, manage risk, and improve capital efficiency.

You might like: The Current State of Bitcoin and Cryptocurrencies! – December 10

To understand MarginFi, there are some key terms to know:

- Margin is the amount of equity a trader has in their account.

- Margin loan is a loan taken out to purchase assets and is secured by the assets purchased (collateral).

- Collateral is the asset that a trader puts up to secure their margin loan (i.e., the position purchased on margin). If the position goes against a trader too far, lenders may liquidate the trader’s position to recoup the value of their margin loans.

- Margin account is the account where margined assets are held.

What is the Difference Between Margin Credit and Borrowing?

The key to thinking about margin is that it is borrowing, specifically to finance trading. Furthermore, if you go to a lending market and borrow USDC, you need to transfer your USDC to an exchange and trade on it. Margin takes the process of borrowing and buying in a single step. Margin is also collateralized by the value of the asset being traded, which gives the margin lender some assurance that they will get their capital back.

In addition, you can stay up-to-date on developments by following Marginfi’s X account or joining their Discord accounts.

As always, none of the margin content should ever be considered financial advice, and no reference to financial assets, securities, derivatives, or other financial products should be considered an endorsement of the above.

Now It’s Time for the MarginFi Airdrop

Steps to participate in the MarginFi airdrop:

- Set up a Phantom Wallet

If you don’t have a Phantom Wallet, you can set one up here: https://phantom.app/: https://phantom.app/.

- Send Solana (SOL) coins to your Phantom Wallet

To do this, you can use your Binance account. If you don’t have an account on Binance. Also, you can register for the exchange with a 20% commission discount.

Once you have your Phantom Wallet, you will need to send Solana (SOL) coins to it. To do this, follow these steps:

- Go to your Binance account.

- Click “Wallet”.

- Click “Deposit”.

- Select “Solana”.

- Click “Copy Address”.

- Paste your Phantom Wallet address into the “Recipient Address” field.

- Enter the amount of Solana (SOL) you want to send.

- Click “Submit”.

Your Solana (SOL) coins will be sent to your Phantom Wallet within a few minutes.

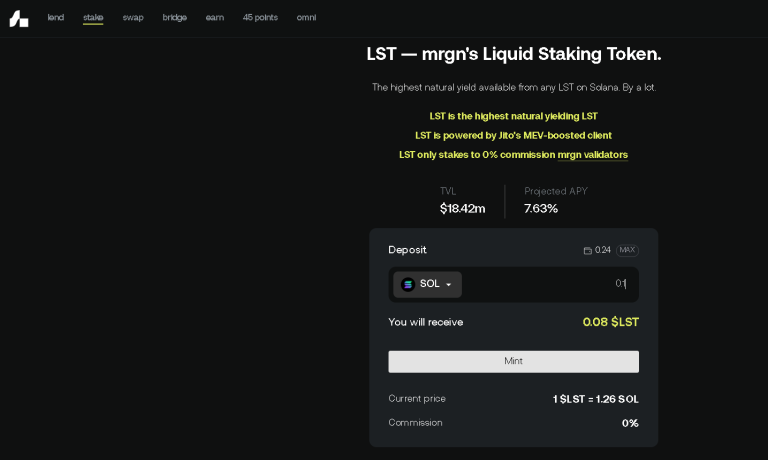

- Stake your Solana (SOL) coins to mint LST tokens

Once your Solana (SOL) coins have arrived in your Phantom Wallet, go to the MarginFi website by clicking here. Connect your Phantom Wallet in the top right corner of the page.

After that, on the MarginFi website, click the “Stake” button. Enter the amount of Solana (SOL) you want to stake. Click “Mint”.

Your Solana (SOL) coins will be staked and converted to LST tokens and this process will take a few minutes.

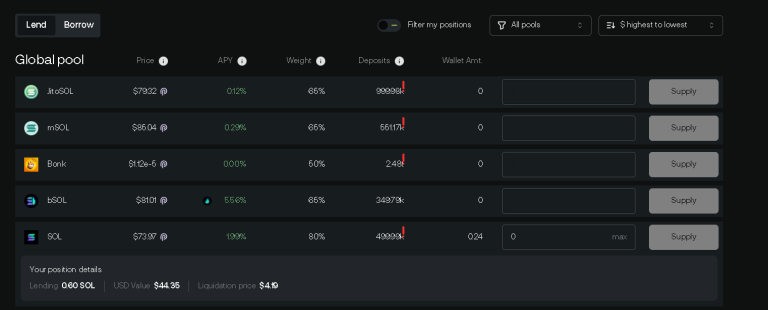

- Lend your LST tokens

Once your LST tokens have been minted, you can lend them out. To do this, click the “Lend” button. Enter the amount of LST tokens you want to lend out. Click “Lend”.

Your LST tokens will be lent out to other users. Thus, you will earn interest on your lent LST tokens.

-

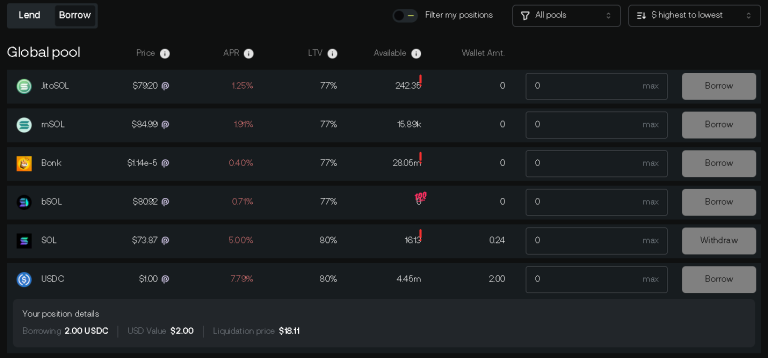

Borrow USDC using your LST tokens

To earn the most points for the airdrop, you will need to borrow USDC using your LST tokens. To do this, click the “Borrow” button. Enter the amount of USDC you want to borrow. Click “Borrow”.

You will need to make sure that the amount of USDC you borrow is less than or equal to half of the value of your lent LST tokens. This is because your LST tokens will be used as collateral for your loan. If the value of your collateral falls below the value of your loan, your loan will be liquidated and you will lose your collateral.

- Claim your airdrop

Once you have completed all of the steps above, you can claim your airdrop and to do this, go to the MarginFi website and click the “Airdrop” button. After that, connect your Phantom Wallet. Then, enter your Phantom Wallet address. Click “Claim”.

Your airdrop will be sent to your Phantom Wallet within a few minutes.

How Will the MarginFi Airdrop Be Calculated?

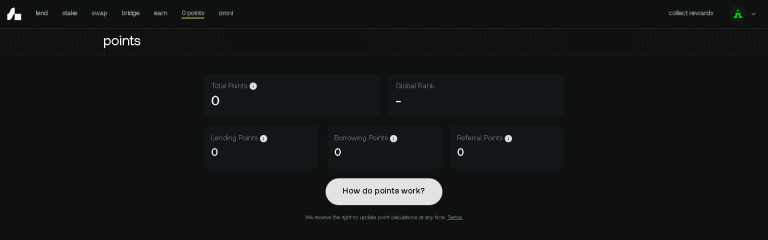

After we complete the following actions, our points will be calculated using a point calculation system: Lend, Borrow, Stake. You can also access these points from the “POINTS” section in the top left corner.

Thus, you can access the operation of the point system [here].

Next to your total points, you will see your ranking. Additionally, I think this ranking will only affect the amount of your airdrop. However, I don’t think there will be any eliminations based on this ranking.

Here is a summary of how the point calculation system works:

- Staking: You will earn 1 point for every SOL you stake.

- Lending: You will earn 2 points for every LST you lend.

- Borrowing: You will earn 5 points for every USDC you borrow.

The maximum number of points you can earn is 100,000.

Also, the airdrop will be distributed to eligible users on a rolling basis. The airdrop will end on January 31, 2024.