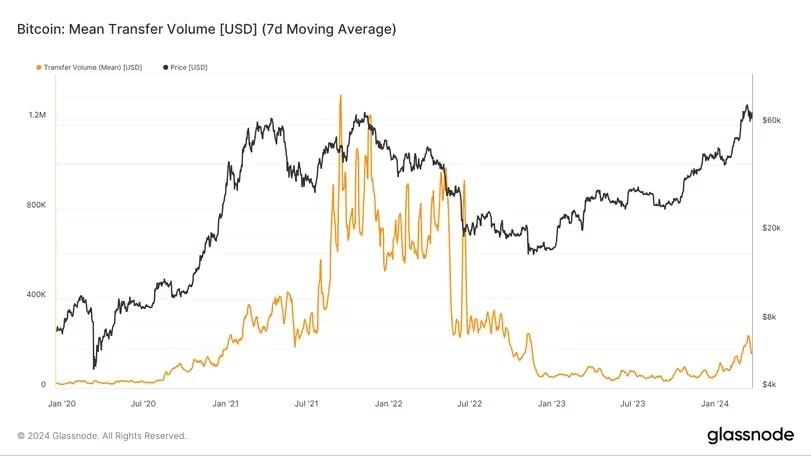

According to one analyst, the lack of significant value being transferred on-chain is a clear indication that there’s little desire to sell Bitcoin. Data from Glassnode reveals that the average value of on-chain transfers on the Bitcoin network remains notably lower than the peak seen in 2021. This trend suggests that investors are holding onto their Bitcoin holdings, anticipating a further increase in prices, as noted by analysts at Blockware Solutions.

Despite Bitcoin‘s recent surge to new all-time highs surpassing $70,000, actual economic activity on its blockchain is showing sluggish growth rather than robust movement.

This divergence is largely attributed to a strong sentiment of holding in the market, according to research from one firm.

In the latest Blockware Intelligence newsletter, analysts pointed out that the average on-chain transfer volume denominated in USD is significantly lower than during the 2021 bull market peak, signaling a reluctance to sell among investors.

The transfer volume, defined by Glassnode as the dollar value of total BTC transferred on-chain, currently stands well below $200,000 for both the seven-day and 14-day averages, contrasting sharply with the million-dollar figures seen during the 2021 bull market.

The recent surge in Bitcoin’s price is largely attributed to the acceptance of Nasdaq-listed spot Bitcoin ETFs by Wall Street. Consequently, spot volume has been concentrated in these ETFs, contributing to the lower on-chain volume.

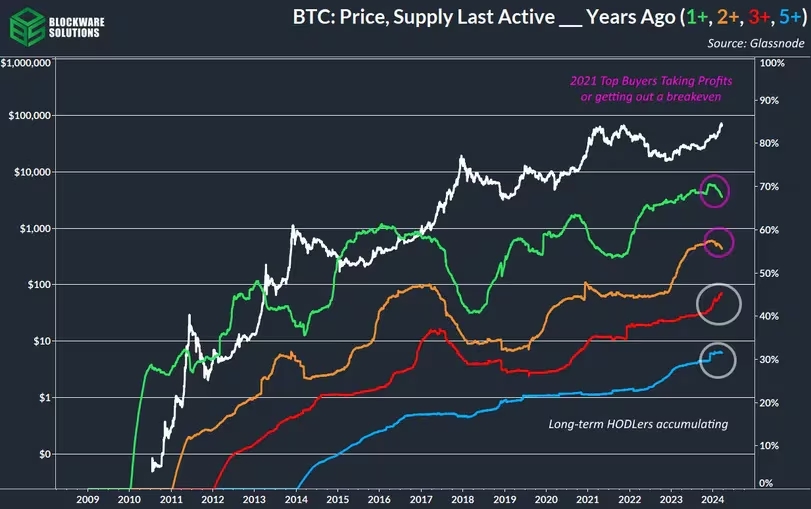

Nevertheless, various metrics indicate that investors who weathered the 2022 bear market are holding onto their Bitcoin holdings in anticipation of further price increases.

For instance, the percentage of Bitcoin supply inactive for three to five years continues to rise. Many analysts foresee Bitcoin’s price rallying to six figures in the coming months, potentially peaking well above $150,000.

Analysts at Blockware anticipate a surge in on-chain volume once the price gains momentum, as older coins are moved to exchanges for selling. Until then, the low on-chain volume suggests a shortage of supply.

At the time of writing, Bitcoin was trading at $67,700, marking a 5% increase over a 24-hour period.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.