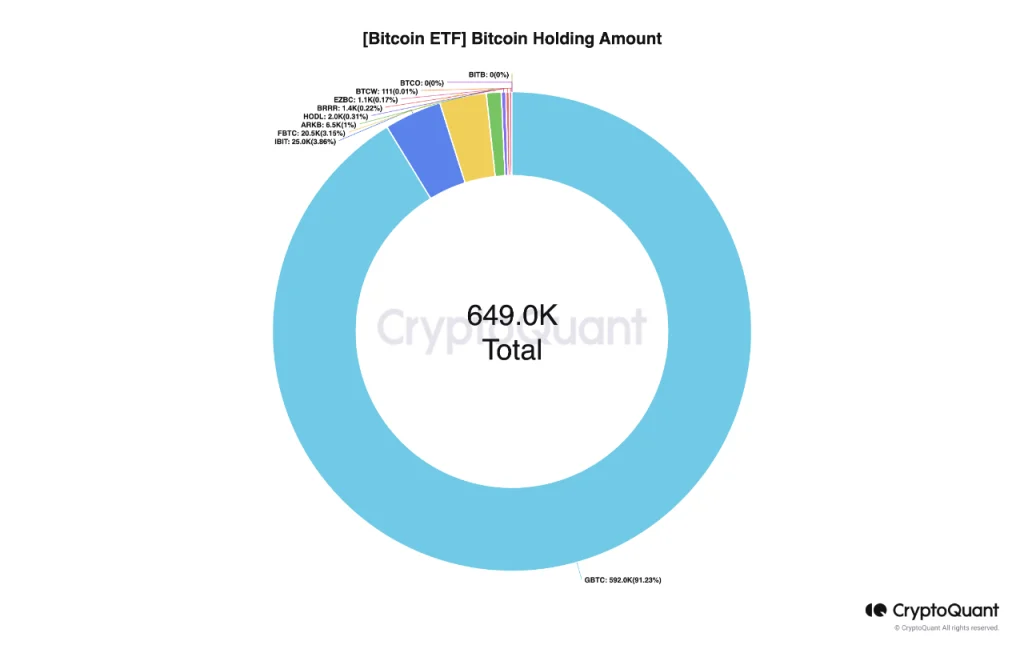

On Chain Analysis: Sign of Evolution in Spot Bitcoin ETFs!! The world of cryptocurrency investing is no stranger to rapid change and dynamic shifts. Recently, the focus has shifted to spot Bitcoin ETF assets, where a significant transformation is underway. A notable moment was the single-day outflow of 13,793 Bitcoin from Grayscale’s GBTC, which stood in stark contrast to the aggregate 21,400 BTC inflows into other ETFs.

You might like: Ripple Challenges SEC!

This apparent contradiction is more than just a series of numbers; it symbolizes a major shift in how institutional investors are placing their strategic bets in the Bitcoin ETF market. These changes offer a glimpse into the changing perspectives of institutional players on the risk, return, and overall investment strategies of cryptocurrencies.

The implications of this shift go beyond Bitcoin’s short-term movements. It suggests that institutional investors have a nuanced understanding of the ever-changing dynamics of the cryptocurrency market. As the landscape of digital assets matures, investors’ approach to this space is maturing as well, and the recent moves in ETF assets are emerging as a sign of this evolution.

On Chain Analysis: Julio Moreno’s dashboard

For a detailed analysis of these market dynamics, Julio Moreno’s dashboard stands out as a valuable resource. With a rigorous analysis of the Bitcoin ETF sector, Moreno’s dashboard presents fundamental data in an accessible format. Investors, analysts, and enthusiasts can rely on this tool to track and interpret changes in ETF assets, allowing them to understand the market more consciously.

The shifting sands of spot Bitcoin ETF assets tell the story of adaptation and strategic decision-making in the cryptocurrency investment landscape. As institutional investors navigate this dynamic space, the importance of data-driven insights cannot be overstated.

Julio Moreno’s dashboard stands out as an indispensable tool that offers clarity and depth for those who want to understand the evolving nuances of the Bitcoin ETF sector. In a world where information is key, it is essential to track these transformations in order to make informed decisions in the ever-changing world of cryptocurrency investing. On Chain analysis points to an evolution in spot Bitcoin ETFs!