Logarithm Finance (LOG) is the revolutioner DeFi platform. It is coming for redesigning DeFi and its structure. As we know DeFi is a new concept for the fintech world. That’s why it is normal, I mean the DeFi has a lot of problems. Here, Logarithm Finance is occurring for repairing that. Its services and product design for that.

What Is Logarithm Finance?

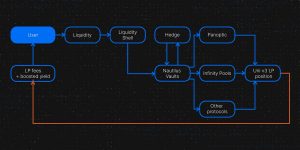

Logarithm Finance is decentralized liquidity management and market-making protocol. The platform builds to achieve the highest available capital efficiency on the market by routing liquidity through various LPDs and hedging exposure to volatile assets.

Actually, Logarithm Finance is simultaneously doing that to provide liquidity to LP-centric protocols and to boost yields while managing LP positions. The protocol earns auto-compounding fees on Uniswap. In this case, it minimizes exposure to volatile assets. So, how can it achieve that? As using delta-neutral strategy.

If you are a market maker (MM) or DeFi native user you can use Logarithm Finance. Besides, if you want to earn passive income, at the same time hedge on your own position you absolutely can use the platform. Even your position won’t affect by rebalance, price gap and impact, etc. And then Logatihm Finance is providing an opportunity for earning the highest APYs while keeping your positions.

Is Logarithm Finance (LOG) Matter?

As we know today DeFi has a lot of problems, especially on the DEX side. There are available slippage, insufficient liquidity, price impact, etc. Logarithm Finance uses a new model for fixing and becoming solve to these problems.

Primarily, if you want to add liquidity to DEXes, you definitely will face some problems like price gap, constant product, temporary loss risk, etc. In addition, there is available position hedging, keeping the liquidity pool active. All of them are literally the problem. That’s why, yes, Logarithm Finance is a matter.

How Can Logarithm Finance Do That?

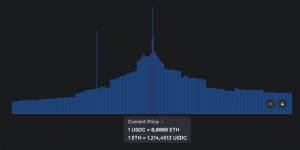

First of all, I want to share a new type of model on DeFi. That is CLMM. The model is using concentrated liquidity strategy. The model’s main purpose is to intensify liquidity between 0 and endlessness. In this case, the platform can decrease slippage ratio, price impact, and other problems. Because all liquidity that the platform has is rollups in one place. That’s why the platform can present to your own users high dealing offers although pools have a little liquidity.

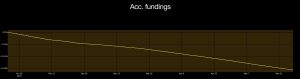

Firstly, Logarithm Finance (LOG) is using this model for saving positions on its own. If the asset has high volatility, the protocol is hedging these positions. For example, currently, the platform uses GMX for hedging. The potential losses are prevented by Logarithm Finance using hedge mode.

In this case, we must back to square one: Delta-Neutral Strategy (D-NS). According to the strategy, the protocol is minimizing all risks as earning interest from DEX. Besides, Logarithm Finance has smart contracts. They are occurring auto-balance as the following price. The contracts support D-NS.

You might also like: What Is Debank? How Can We Get an Airdrop?

The First Product: Nautilus Vault

The product is working the user just must do that: To add USD Coin to Vault. I mean the user doesn’t care about adding LP, Hedging for saving its own position, following price, reset positions, etc. Because Nautilus Vault contains smart contracts for doing them. Furthermore, you can close your positions when you want. There aren’t any lockings.

Is This Product Successful?

We must look at backtest results for knowing that. Details of procedure like that. Platform: UniV3, Parity: ETH/USDC, Pool: %0.03, Hedge: 2x-4x on GMX. Period: 1 month, APR: %12.

The position is followed by smart contracts. That’s why price bound has a specific range. If the price is out of range, the contract is correcting it automatically.

The maximum leverage is 4x. It is a matter of hedging position and keeping price bound on distinct areas.

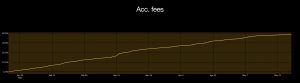

Again, the protocol earns a fee of almost %40 on Uniswap. Logarithm Finance is providing hedging positions losses thanks to them.

On the other side, the protocol has some spending on the GMX for hedging. It can fulfill its own spending thanks to Uniswap fees.

The Second Product: Liquidity Shell

The product is a “compiler”. Liquidity Shell is compiling algorithm and it scans all LP opportunities after this presents the best of it. Hence, the user doesn’t waste time finding the best offer in DeFi.

What Is a LOG Token?

LOG Token is a governance token. Users who have a LOG Token can choose vaults’ APR ratios and vote for changes to the protocol. Additionally, these users can stake their own LOG Token. The feature is named governance staking.

In conclusion, LOG tokens have a utility status such as supporting liquidity mining initiatives. In future applications, it may also have.

- Name: Logarithm Token

- Ticker: $LOG

- Chain: Arbitrum

- Max supply: 100.000.000

How To Buy a LOG Token?

Right now, the project has the second phase on its own roadmap. Speaking of which if you want to reach the roadmap, you can interact with the link. Currently, Logarithm Finance is in the early stage. Mainnet and Public sales will come in Q3 2023. The token sale will hold in two phases: Private and Public.

You can present your thoughts as comments about the topic. Moreover, you can follow us on Telegram, Twitter, and YouTube channels for the kind of news.