The US Securities and Exchange Commission (SEC), approved Bitcoin spot ETFs by a vote ratio of 3 to 2. However, the Republicans and Democrats were once again split over a new series of rules that would affect the crypto and DeFi industry. The new regulations, which have been accepted, place those who provide liquidity to automatic market makers under the SEC’s control mechanism. The crypto industry is strongly opposed to this new practice.

You might like: BlockFi and Three Arrows Capital (3AC) Reach Settlement!

Regulations approved by the SEC, they have adopted new rules to regulate market makers and hedge funds. Even though the US bond market was targeted initially, these rules indirectly affect the crypto and DeFi areas.

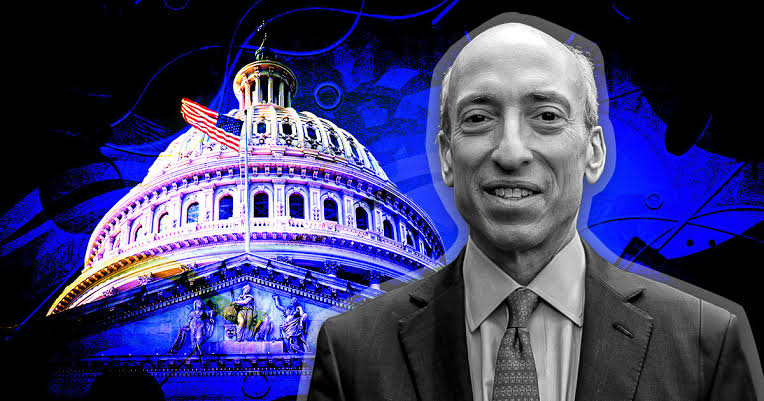

The Chairman of SEC approved ETFs

The SEC, while approving the 247-page regulations with Gary Gensler and two members, was rejected by Hester Peirce and Mark Uyeda. Although the votes were split on Bitcoin spot ETFs, Chairman Gensler approved these ETFs.

The Commissioner known for her positive approach to the crypto industry, Commissioner Hester Peirce stated, “The reason these structures are not regulated is that our rules are not clear”. Mark Uyeda, who voted with Peirce, said, “These rules target private funds, private equity trading funds, and those who trade in bond markets. It also causes confusion in other markets where ‘crypto asset securities products’ exist.”

In the vote, Peirce and Uyeda voted “No,” while Chairman Gensler, along with Caroline Crenshaw and Jaime Lizarraga, said “Yes.”

The constant advancement of technology makes major liquidity providers (like hedge funds) join markets like US bonds more and more. Most of these hedge funds are not regulated. The markets becoming more automation-focused is seen as one of the biggest concerns of the US Securities and Exchange Commission (SEC).

The new rules as a whole reinterpret the definition of a brokerage firm and aim to control hedge funds, market makers, and high-speed trading firms that trade in the securities field.

The SEC considers most cryptocurrencies as securities and thus targets even hedge funds that do not have cryptocurrency in their portfolios, thereby indirectly entering the crypto and especially the DeFi field.