Recent developments in the SHIB market have caught the attention of cryptocurrency executives, with contrasting actions sparking interest among investors.

Rune Christensen, the co-founder of MakerDAO (MKR), made significant purchases of Shiba Inu (SHIB) tokens on March 1st and 3rd. His acquisitions totaled 7.41 billion and 17.62 billion SHIB tokens respectively. Notably, between Christensen’s two purchases, SHIB‘s price surged by 60%. Following his latest acquisition of $400,000 worth of SHIB, the token’s price jumped by an additional 20%.

However, Christensen isn’t the only crypto founder involved in SHIB transactions. Justin Sun, founder of Tron (TRX), recently transferred $544,400 worth of SHIB to Poloniex from cold storage. This move suggests Sun may be considering booking profits, contrasting Christensen’s bullish stance on SHIB‘s long-term potential.

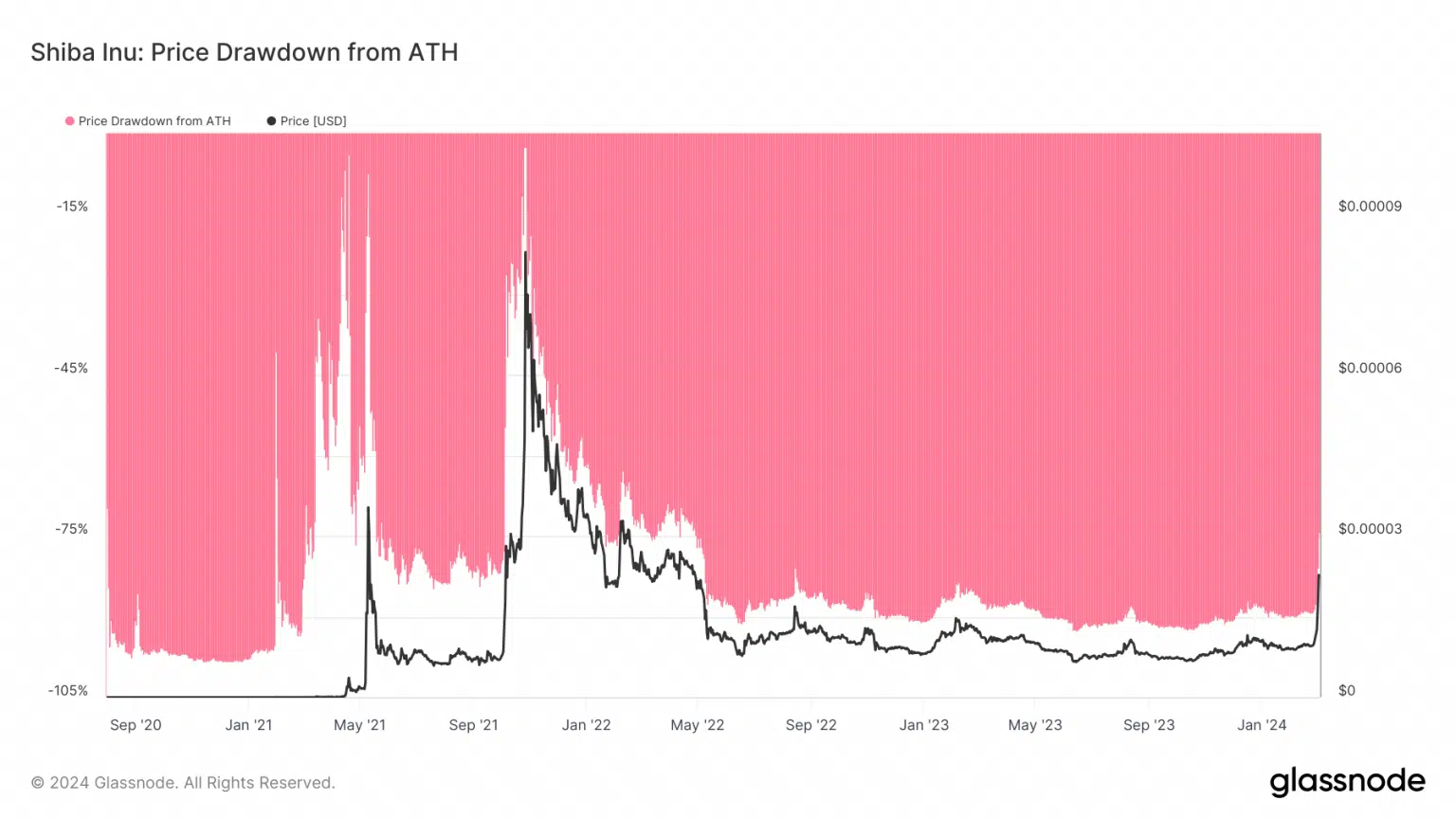

As of now, SHIB is trading at $0.00002691, marking a remarkable 182.50% increase over the past seven days. Despite being 89.51% down from its All-Time High (ATH) on February 25th, recent price surges have altered SHIB‘s trajectory, bringing it 74.38% closer to its 2021 high.

From a technical standpoint, SHIB‘s Fibonacci extension suggests potential for further price increases. The 0.618 Fib level sits at $0.000030, indicating profitable entry points for long-term investors. Additionally, the 3.618 Fibonacci extension projects a potential price target of $0.000070, offering hope to long-term token holders.

Recent technical indicators support SHIB‘s bullish outlook, with the 50-day Exponential Moving Average (EMA) crossing over the 200-day EMA, signaling a solid bullish trend. Furthermore, the Chaikin Money Flow (CMF) indicates increasing buying pressure, with a reading of 0.18 at the time of writing.

However, traders should remain vigilant as a CMF crossing of 0.20 could indicate overbought conditions, potentially leading to a price retracement. Nonetheless, a downward reversal does not necessarily signify the end of bullish momentum, but rather a temporary cooldown before potential resumption.

In the comment section, you can freely share your comments about the topic. Additionally, don’ t forget to follow us on Telegram, YouTube, and Twitter for the latest news and updates.