Uniswap is a decentralized exchange(DEX) and an automated market maker (AMM). An automated market maker is a software-based mechanism that ensures liquidity ratios are monitored to prevent price disparities. Uniswap operates as a decentralized finance (DeFi) platform that facilitates various trading activities, including swaps and more. It is primarily built on the Ethereum blockchain but also extends compatibility for transactions on networks like BNB Chain and Polygon.

You might also like: What Is Mock Trading?

What Purpose Is It Used?

The decentralized exchange Uniswap revolutionizes token trading by enabling direct peer-to-peer transactions through user-friendly wallets like Metamask, eliminating the need for centralized exchanges. By leveraging Uniswap, users can effortlessly exchange their desired tokens while retaining full control over their assets.

Uniswap goes beyond just facilitating trades. It empowers its users to participate in liquidity pools, which generate passive income based on the amount of liquidity provided. This innovative feature allows individuals to earn interest by contributing to these pools for a specified duration.

Moreover, Uniswap offers seamless access to NFT collections available on the OpenSea platform, providing users with the opportunity to buy or sell these unique digital assets whenever they desire.

By operating in a completely decentralized manner, Uniswap respects and safeguards the privacy of individuals. Unlike traditional financial institutions that often prioritize surveillance, Uniswap ensures that your anonymity remains intact. Your assets are truly yours and should always remain under your control, independent of any external authority.

What is UNI Token ($UNI)?

Uniswap, being a decentralized exchange, operates as a Decentralized Autonomous Organization (DAO). As with other decentralized organizations, Uniswap employs its native currency for community governance within the platform. Introduced in 2020, the cryptocurrency utilized for this purpose is UNI. UNI is an ERC-20 token and can be acquired through the Binance exchange. With a total supply of 1 billion tokens, there are currently 577.5 million UNI tokens in instant circulation.

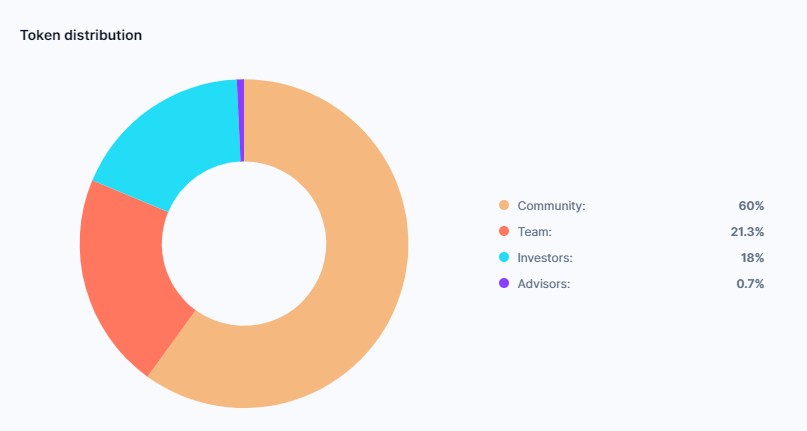

Token Distribution

According to the allocation of Uniswap tokens, community members will receive 60% of the entire supply, followed by investors (18%), team members (21.3%), and consulting firms (0.7%). These tokens will be distributed over a four-year period with a 2 percent inflation rise. In actuality, this distribution will be finished in 2024. Prior to 2020, users received 15% of the rate allotted to the community via airdrop.

You can present your own thoughts as comments about the topic. Moreover, you can follow us on Telegram and YouTube channels for this kind of news.