Those following the cryptocurrency markets, particularly Bitcoin futures, observed that approximately $155 million worth of short positions were liquidated in the last 24 hours after a sudden surge in prices during U.S. hours.

Investors betting against higher Bitcoin (BTC) prices experienced losses of over $100 million in the last 24 hours, as expectations for the approval of a spot Bitcoin exchange-traded fund (ETF) in the U.S. approached the finish line.

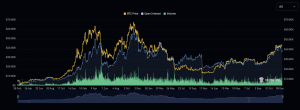

BTC prices rose up to 9% on Monday as they surpassed $47,000 for the first time since March 2022, resulting in some gains. Traders on the crypto exchange OKX incurred the highest losses, totaling $84 million, followed by Binance traders with $71 million in losses.

The number of open positions or yet-to-be-settled futures contracts rose by over 8% in the last 24 hours, indicating that investors opened more positions after the liquidation event, expecting continued volatility.

Liquidation occurs when an exchange forcibly closes a trader’s leveraged position due to the trader not meeting the margin requirements (not having enough funds to keep the position open).

Large liquidations can provide a signal of a significant local peak or bottom in price, allowing investors to position themselves accordingly.

Such data is valuable for investors as it serves as a signal that leverage is effectively being wiped out from popular futures products, acting as an indication of a decrease in short-term volatility.

You may notice: Ripple CTO Schwartz, XRP Buyback Rumors

Monday’s market movements came as various potential issuers, from BlackRock (BLK) to Grayscale, submitted their fee proposals to the U.S. Securities and Exchange Commission (SEC); this signaled one of the final steps before the first Bitcoin ETF is publicly offered in the market.

Thirteen proposed ETFs are awaiting SEC approval, and the competition for clients is already heating up; some issuers are not charging any fees for the first six months or requesting $5 billion in assets under management (AUM).