Galaxy Digital predicts a 74% increase in Bitcoin price after ETF launch!

The approval of spot Bitcoin exchange-traded funds (ETF) in the US, the price of Bitcoin is expected to increase by 74.1% within a year. Cryptocurrency investment firm Galaxy Digital made this prediction. Charles Yu, a research associate at Galaxy Digital, predicts that the total accessible market size will reach $14.4 trillion immediately after the launch in the first year of Bitcoin ETFs. He evaluated the potential price impact by referring to gold ETFs to reach this figure.

You might like: What is the Reason for the Big Rise in Mina (MINA) Coin?

Charles Yu: “Bitcoin’s value will raise over $59,000”

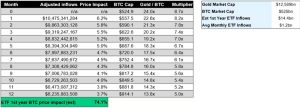

According to Yu’s projections, the Bitcoin price will increase by 6.2% in the first month after the ETF launch, and by 3.7% monthly in the twelfth month. Using Bitcoin price data on September 30, the 74.1% increase will raise Bitcoin’s value to over $59,000.

Estimated entries and Bitcoin price effect for each month during the first year of Spot Bitcoin ETF.

Source: Galaxy Digital Research

Markus Thielen from Matrixport predicts that Bitcoin could attain a value ranging from $42,000 to $56,000 in the event of the approval of BlackRock’s spot Bitcoin ETF application.

Yu predicts that the accessible market size of Bitcoin ETFs in the US will reach $26.5 trillion by the end of the second year and $39.6 trillion by the end of the third year. However, he admits that the delay or rejection of these ETFs could have an impact on the predictions, but stresses that these estimates are still conservative.

Also, Yu draws attention to the “second-degree effects” that may arise after the approval of spot Bitcoin ETFs. He mentions the high likelihood of other international markets following the US and approving similar Bitcoin ETFs to offer to a broader investor base. As a result he suggests that ETF entries, the Bitcoin Halving event in April 2024, and changes in interest rates could potentially spark 2024.

In the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube, and Twitter for the latest news and updates.