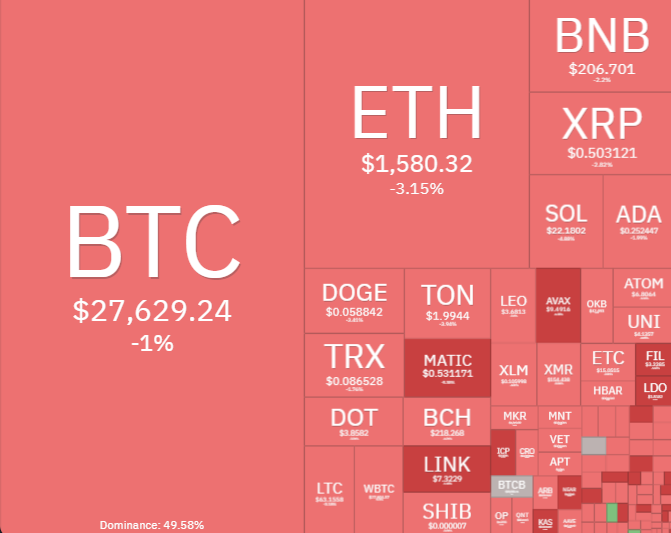

How will the war affect the markets? Bitcoin (BTC) and Ethereum (ETH), continue to show signs of stability even during a period when the broader stock market is falling and oil prices are rising. In the last 24 hours, Bitcoin and Ethereum recorded a nearly %2.5 drop. On the other hand, XRP fell 2% while Cardano (ADA) was one of the best-holding assets with a 1.5% drop.

The Israel-Hamas conflict began on Saturday with the firing of missiles by Palestinian militants Hamas at Israel and entered its third day on Monday. The fear that this conflict might affect neighboring countries, particularly Iran, negatively impacted oil prices. Traders suggest that oil prices could rise over concerns that the conflict could interrupt supply.

Especially financial markets involving risky assets do not like wars or similar situations. You can think of this as an individual or corporate investor investing in countries. If that country is a hotspot, with a high chance of exposure to war, it receives less investment. The same goes for the assets in these financial markets. Investors sell all assets to protect their portfolios from the effects of war.

You might be interested in: How is Crypto Affected because of Wars?

Therefore, in such serious situations, crypto assets associated with the region and country can be coolly received by investors.

Bison Interests’ chief investment officer Josh Young, noted that sanctions against Iran, if imposed by the US, could make an “impactful” difference in the oil market. Young, in an interview with CNBC, said, “I think for WTI, the price of oil could rise about 5 dollars.”

According to MarketWatch data, How Will War Affect the Markets?

According to MarketWatch data, WTI Crude oil has increased by almost 4% since Sunday, quadrupling its three-month gain. On the other hand, Brent Crude oil rose almost 3.5%.

During wars, there have always been increases in the shares of companies providing crude oil, technology, and military services. Because the demand for these products is greater than ever during war. As the buyers for these products increase in the market, the demand for them also increases, resulting in inevitable price increases.

Stock markets in Asia saw declines following Monday’s opening. India’s Sensex index slipped by 0.7%, the Shanghai Composite Index fell by 0.5% and the Singapore Straits Times Index dropped by 0.25%. Futures markets in the US are also suggesting losses; the Dow Jones index fell by 0.77%, while the tech-heavy Nasdaq 100 index dropped by 0.86%. These movements are reflecting volatility in global financial markets and raising concerns among investors.

In the comment section, you can freely share your thoughts and comments about the topic. Additionally, please don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news.