JPMorgan issued a warning to investors on Thursday, highlighting the potential risks associated with MicroStrategy’s aggressive Bitcoin purchases. The investment bank expressed concerns that MicroStrategy’s $2 billion worth of Bitcoin acquisitions over the past six months, funded through debt, could exacerbate any future market downturn.

MicroStrategy’s Debt-Fueled Bitcoin Strategy Raises Concerns

According to a recent investor note, JPMorgan analysts believe MicroStrategy’s reliance on debt to finance its Bitcoin purchases injects additional leverage and volatility into the current crypto rally. They warn that this strategy could lead to a more severe “deleveraging” process if the market experiences a downturn. The specific details of this potential deleveraging scenario were not elaborated upon in the report.

Senior Convertible Notes Facilitate Bitcoin Purchases

MicroStrategy’s most recent Bitcoin buying spree, totaling $821 million between February 26th and March 10th, was reportedly funded through the sale of $1.2 billion in senior convertible notes earlier this year. These notes function like bonds, offering interest payments to investors and ranking ahead of other debts in case of company insolvency. However, they also hold the potential to convert into company shares under certain circumstances.

JPMorgan Links MicroStrategy’s Actions to Market Rally

JPMorgan suggests that MicroStrategy’s decision to essentially transform itself into a leveraged bet on Bitcoin has further fueled the ongoing cryptocurrency rally. The investment bank highlights the recent sale of convertible notes as evidence of this strategy and its potential impact on the market.

MicroStrategy’s Bitcoin Ambition

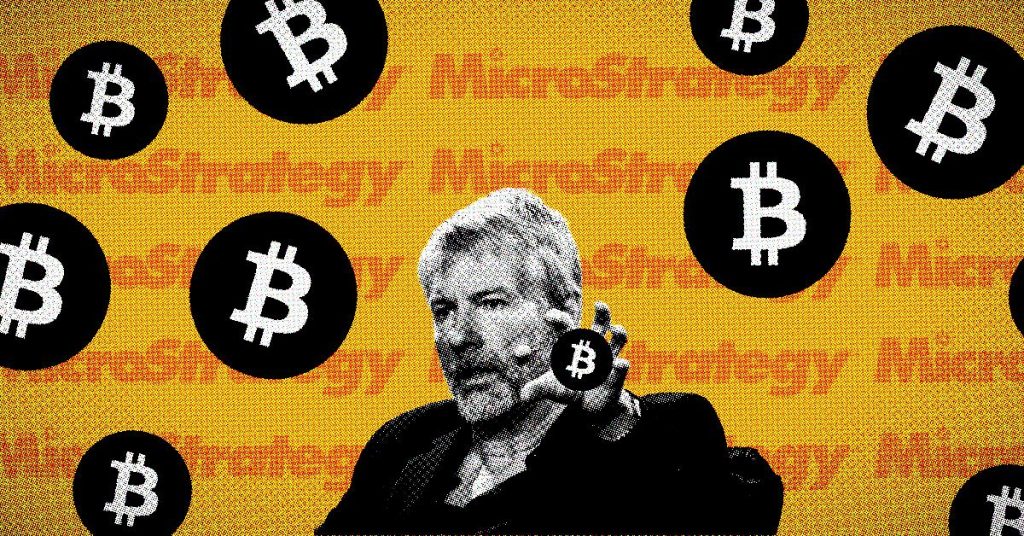

Led by Bitcoin advocate Michael Saylor, MicroStrategy has embarked on an aggressive Bitcoin acquisition campaign. This strategy aligns with the company’s stated goal of becoming a “Bitcoin development company.” MicroStrategy is currently the world’s largest private holder of Bitcoin, boasting a stash of 205,000 coins valued at roughly $14.7 billion, according to Bitcoin Treasuries.

Feel free to share your thoughts on the topic in the comments. Besides, don’t forget to follow us on Telegram, YouTube, and Twitter for more analysis and updates.