The SEC is seeking financial information from Ripple that the company does not want to provide as the lawsuit against Ripple continues.

You might like: DOOM is now on the Dogecoin blockchain!

U.S. District Judge Sarah Netburn is considering the latest chapter in the legal battle between Ripple Labs and the U.S. Securities and Exchange Commission (SEC). The focus of the dispute is Ripple’s financial condition and institutional sales agreements; the SEC hopes to examine this information in hopes of bolstering its case in the ongoing litigation.

In a letter to Judge Netburn on January 11, the SEC requested an order compelling Ripple to produce its financial statements for 2022 and 2023 and institutional sales agreements made since the company was sued by the SEC in late 2020. In a summary judgment in July, Judge Analisa Torres found that XRP’s institutional sales passed the Howey test and were equivalent to securities sales.

Ripple responded to the SEC’s request in a letter to Judge Netburn on January 19, stating that the discovery phase of the case was completed in August 2021. It argued that actions taken during that time period were not relevant to the case. It also argued that the issue of whether it has the ability to pay potential penalties is irrelevant because it did not plan to make such a claim.

I said 4 days ago that the SEC needed to show Judge Torres that ordering discovery of the post complaint contracts will not lead to a mini-trial of the status of post contract sales as Ripple argues. This is an extract from the SEC’s just filed Response courtesy of @FilanLaw who… https://t.co/qV6XhVVdZw pic.twitter.com/ZHTZDnG83u

— bill morgan (@Belisarius2020) January 24, 2024

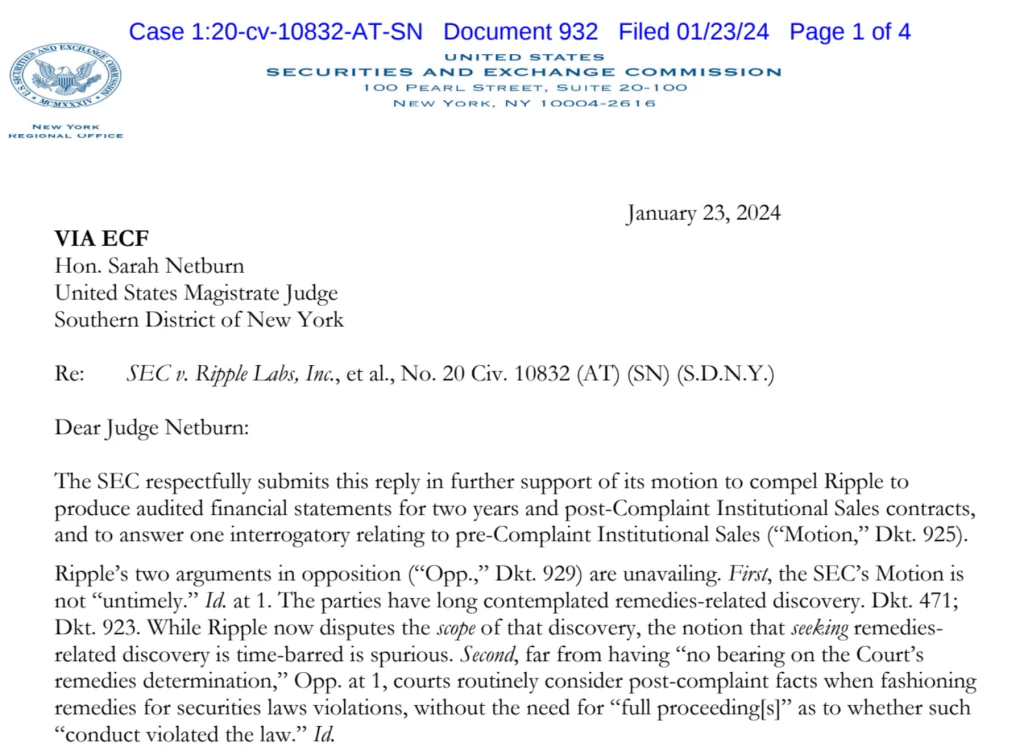

The SEC filed a response on January 23,

The SEC filed a response on January 23, arguing that Ripple “has not even alleged that it would be harmed by producing its latest financial statements.”

“In determining the amount of a penalty necessary to deter future misconduct, the financial condition of the defendant is a relevant factor,” the SEC argued in its response.

⚖️Unpacking the SEC's reply to #Ripple⚖️

(#5 will be discussed!)

The SEC wants 3 things:

1) Audited financial statements for '22 & '23

2) All post-complaint contracts for #XRP sales

3) The XRP Institutional Sales proceeds received after the complaint

1/7https://t.co/A6Qoj7pruZ— WrathofKahneman (@WKahneman) January 24, 2024

The response also notes that Judge Torres has left open the possibility of further discovery proceedings. According to the SEC, Ripple’s financial position and post-litigation actions are indeed relevant because the Securities Act (likely enacted in 1933) “considers interventions in cases where ‘violations are likely to occur'” and can help determine the likelihood of a violation recurring. Moreover, because of the definition of a sale, compliance with a post-litigation order could affect the amount of disgorgement.

The case is still ongoing, and it is unclear when Judge Netburn will rule on the SEC’s request. The outcome of the case could have significant implications for the cryptocurrency industry as a whole.

Also, in the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube and Twitter for the latest news and updates.