Silvergate Capital Corporation, a crypto-friendly bank that liquidated and closed its doors last year, has agreed to settle with the U.S. Securities and Exchange Commission (SEC) after being accused of making false statements regarding its anti-money laundering (AML) procedures. The SEC’s lawsuit, filed on Monday, alleges that Silvergate failed to detect nearly $9 billion in suspicious transfers by FTX and its related entities.

The SEC‘s complaint also named Silvergate’s CEO Alan Lane, former COO Kathleen Fraher, and former CFO Antonio Martino. The SEC accused Silvergate of having an inadequate Bank Secrecy Act and AML compliance program, specifically lacking proper measures to monitor the Silvergate Exchange Network (SEN), which allowed customers to transfer funds. The bank allegedly failed to monitor approximately $1 trillion in banking transactions on the SEN for suspicious activity.

Silvergate, Lane, and Fraher agreed to settle with the SEC without admitting or denying the allegations. Silvergate agreed to pay $50 million in fines, while Lane and Fraher agreed to pay $1 million and $250,000, respectively, and accepted permanent injunctions. Martino did not agree to settle. Additionally, the Federal Reserve Board and the California Department of Financial Protection and Innovation also announced settlements with Silvergate.

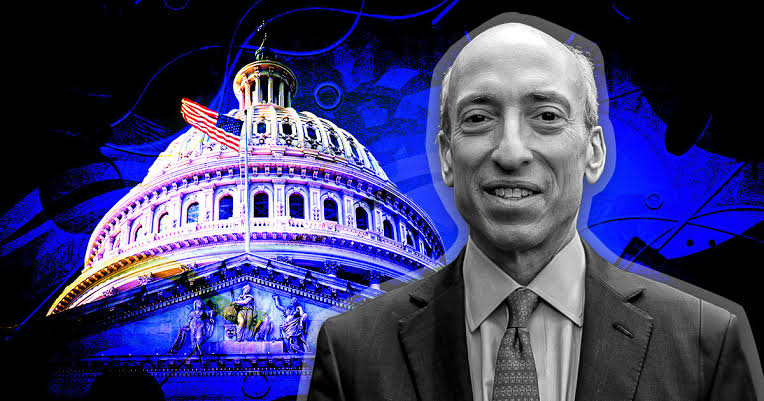

Gurbir Grewal, the SEC’s Director of the Enforcement Division, stated, “Rather than coming clean to investors about serious deficiencies in its compliance programs in the wake of the collapse of FTX, one of Silvergate’s largest banking customers, they doubled down in a way that misled investors about the soundness of the programs. In fact, because of those deficiencies, Silvergate allegedly failed to detect nearly $9 billion in suspicious transfers among FTX and its related entities.”

Silvergate has not yet responded to requests for comment. The bank faced a crisis following FTX’s bankruptcy filing in late 2022, which triggered a run on customer deposits. Silvergate subsequently revealed in a regulatory filing that it might be “less than well-capitalized” and was “re-evaluating its business,” leading to a sharp decline in its shares and the severance of ties by major companies such as Coinbase, Circle, Paxos, and Gemini.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.