SEC (U.S. Securities and Exchange Commission), Bitcoin ETF (Exchange-Traded Fund) approval decision could be announced in the coming days, and here are the potential movements we can observe in Bitcoin.

Bitcoin ETFs could be a significant step in the cryptocurrency market as it may facilitate access for traditional financial system investors to crypto assets. The SEC’s process of approving or rejecting such ETFs is closely watched because it can have a substantial impact on the markets. If the applications of these 14 asset management companies are approved, it could affect the cryptocurrency markets, seen as a broader acceptance of Bitcoin and a step in regulatory compliance.

However, the SEC has had reasons to reject similar applications in the past, citing concerns such as market manipulation and inadequacies. These concerns could complicate the approval of Bitcoin ETFs. The news suggests that the SEC is evaluating the situation and may make an announcement on a specific date.

You might be interested in: Latest Situation in Bitcoin and Cryptocurrencies! – 31 December

If these ETFs are approved, it could lead to increased adoption of Bitcoin by more institutional investors and traditional financial institutions. However, in case of rejection, the crypto market may be exposed to short-term fluctuations.

Cryptocurrency markets are often highly influenced by such news, so investors and market participants should closely monitor these developments. However, it’s crucial to carefully evaluate such news and market fluctuations before making any investment decisions.

Bitcoin has been experiencing a price consolidation between $40,000 and $45,000 for a long time, and there is currently uncertainty in the market. When the chart is examined, a contraction is observed in Bitcoin.

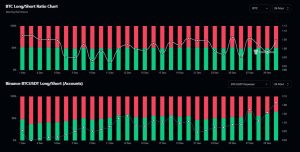

Even though Bitcoin has caught a small uptrend, it has not yet broken out in a clear direction. When we look at the Long/Short ratios, we see a significant number of Long positions, indicating that market makers may want to balance their positions.

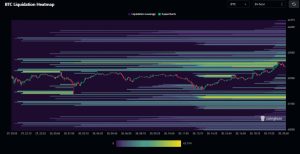

Looking at the liquidation map, we see an accumulation of around $42.12 million in liquidations at around $41,264. Before the SEC ETF news, Bitcoin may experience a liquidation shock.