EigenLayer, after Lido, has now become the second-largest DeFi protocol, replacing Aave.

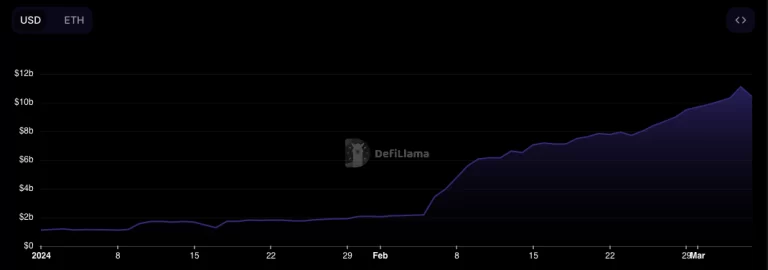

The Ethereum staking protocol, EigenLayer, after temporarily removing a limit on the amount users can stake, surpassed the compromise protocol Aave in terms of the total value locked (TVL) and now owns a crypto asset worth 10.4 billion dollars linked to the protocol.

EigenLayer reached a figure of 11 billion dollars, its all-time high TVL on March 5, and according to DefiLlama data, outperforming Aave’s 21-month high of 10.7 billion dollars in TVL and became the second-largest decentralized finance (DeFi) protocol in terms of TVL after staking giant Lido.

Both TVLs later decreased slightly, EigenLayer became 10.4 billion dollars and Aave was 10.35 billion dollars.

According to Token Terminal data, Aave’s daily active user count is over 5,700, while Lido’s is less than 430.

Aave faced difficulties in the last two weeks; long-time risk manager Gauntlet, left on February 21 over allegations of struggling to resolve the “consistent guidelines and unwritten objectives” of major stakeholders. Gauntlet’s departure occurred two months after signing a one-year, 1.6 million dollar contract with Aave. Shortly after, on February 28, Gauntlet partnered with rival DeFi lending protocol Morpho.

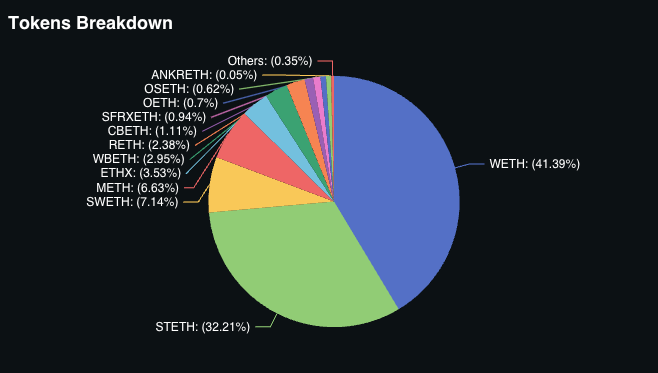

EigenLayer Liquid stake protocols

Liquid stake protocols, providing a 1: 1 token for the funds users stake, are considered the largest category in DeFi; it has almost 55 billion dollars of locked value in approximately 160 protocols. This category is usually led by Lido, which is the largest protocol with a locked value of 35 billion dollars.

With only two protocols, Restaking is ranked as the sixth-largest category, falling behind 125 projects that use collateralized credit to create stablecoins.

You can freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram ,YouTube and Twitter channels for the latest news and updates.