What is BounceBit?

BounceBit is a native BTC restaking chain providing the basic security of Bitcoin. This platform network secures the network by staking Bitcoin and BounceBit tokens. BounceBit’s PoS mechanism offers a unique dual token staking system along with full EVM compatibility. It allows users to contribute to security by staking both Bitcoin and BounceBit tokens.

One of the most important features of BounceBit is that it offers an approach that combines DeFi (decentralized finance) and CeFi (centralized finance) yield mechanisms. This enables users to gain returns both with native validator staking and the DeFi ecosystem. Furthermore, thanks to a CeFi mirroring mechanism supported by Ceffu and Mainnet Digital, users can also earn returns on CeFi platforms.

This return mechanism of BounceBit not only increases the yield potential of crypto but also contributes to the security of the network. These features reveal the importance and innovative approach of BounceBit in the Bitcoin ecosystem.

On the other hand, BounceBit plans to move to testnet in March and to mainnet in April.

Click on the link for detailed review and registration.

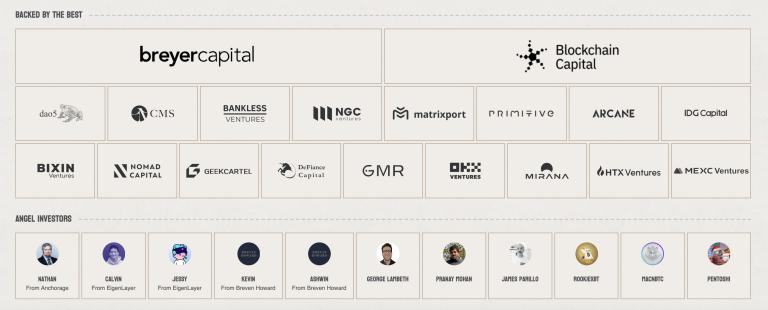

Who are the Investors?

We see exchanges like OKX among the investors of BounceBit, along with individuals from large establishments like EigenLayer.

PoS: Stands for “Proof of Stake” and it defines the block validation process in a cryptocurrency network. In the PoS protocol, the right to validate a block is determined according to the cryptocurrency (token) you have. So, the more tokens you have, the more chances you have to validate blocks. It differs from other algorithms like PoW by reducing energy consumption and providing a more environmentally friendly mining.

EVM: Stands for Ethereum Virtual Machine. EVM is a virtual machine that runs smart contracts in the Ethereum blockchain. It is a Turing complete system, i.e., it can solve any computational problem. This provides developers with the flexibility to create complex smart contracts and decentralized applications (DApps). It runs on all nodes in the Ethereum blockchain and verifies the validity of transactions on the blockchain.

DeFi: short for “Decentralized Finance”, and it means decentralized finance. It is an ecosystem developed as an alternative to traditional finance systems. DeFi enables the provision of financial services in a decentralized manner through blockchain technology and smart contracts. This includes lending, borrowing, swapping, insurance, and many other types of financial transactions. It is developed with aims such as expanding access to services, making financial transactions fast and economical, and making the financial system more transparent.

CeFi: stands for “Centralized Finance” and it means centralized finance. It refers to a structure where financial services are provided and managed by central authorities or organizations. Services provided through banks, financial institutions, and other intermediaries usually fall under CeFi. These types of services can provide advantages such as reliability and compliance, but they can be costly and exposed to centralization risks. Decentralized systems reduce risks and make financial services accessible by a wide audience.

- In order to use BounceBi, you need to register on the platform beforehand. You can register using our registration link and take advantage of many opportunities.

- You can access our other blog content here.

Also, in the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube and Twitter for the latest news and updates.